Remgro’s Vumatel and DFA valuation under the spotlight

Remgro’s Community Investment Ventures Holdings (CIVH) valuation is under the spotlight following its declining performance over the last year.

In November 2021, Vodacom signed a deal with Remgro’s Community Investment Ventures Holdings (CIVH) to buy a stake in Maziv, which owns Vumatel and DFA.

Vodacom would acquire between 30% and 40% of Maziv through a combination of fibre assets of R4.2 billion and cash of at least R6.0 billion.

The proposed transaction will dilute Remgro’s indirect interest in DFA and Vumatel. However, it will get an indirect interest in Vodacom’s fibre assets.

Despite Vodacom and Remgro signing the deal in November 2021, the Competition Commission prevented the mobile operator from investing in Maziv.

The Competition Commission took two years before, in August 2023, it recommended that the Competition Tribunal prohibit the deal between Vodacom and Maziv.

Another year later, in October 2024, the Competition Tribunal ruled that the proposed transaction was prohibited.

This was a blow to Vodacom and Remgro, who vowed to fight the ruling. The Competition Appeal Court dates have been set for 22 to 24 July 2025.

“Remgro and CIVH remain committed to the proposed transaction,” Remgro said in its recent financial results announcement.

It argued that the transaction will deliver significant benefits to South African consumers and the broader economy.

“These include the very real and tangible positive social impacts relating to critical issues such as the democratisation of the internet in lower income areas,” it said.

Other benefits include greater access to cheaper fibre to the broader South Africa, job creation, and economic growth.

The most significant benefit is that Vodacom’s money will strengthen Maziv’s balance sheet and give it the breathing room to invest in further fibre rollouts.

Vodacom said it showcased “the strong public interest and pro-competitive advantages of our proposed joint venture”.

Remgro’s CIVH valuation

The deal has dragged on so long that the financials may have to be renegotiated if the Competition Appeal Court rules in favour of Remgro and Vodacom.

Remgro’s head of strategic investments and CIVH chairman, Pieter Uys, explained that they might negotiate revised terms if the deal goes through.

Uys explained that when they signed the deal in 2021, the CIVH valuation was based on an earnings before interest, taxes, depreciation, and amortisation (EBITDA) multiple.

This EBITDA multiple negotiation had an end date of March 2023, after which that mechanism had no future.

After March 2023, Remgro and Vodacom revisited the transaction terms and agreed on an escalating fixed valuation starting in April 2023.

They intended to escalate it for six to nine months, by when they expected to have a deal. However, the Competition Tribunal delayed the issue for much longer.

“It is time to review the transaction again,” Uys said. “We are looking at a new way of doing the valuation, because the way we did it before is irrelevant today.”

The deal would still include R6 billion in cash from Vodacom and its fibre assets, including towers, fibre-to-the-business, and fibre-to-the-home networks.

“Vodacom will then, depending on the valuation, top it up to get to at least 30% of the shareholding of Maziv,” he said.

CIVH valuation compared to Telkom

Remgro’s financial results for the six-month period ending 31 December 2024 valued CIVH at R26.1 billion.

The best company to compare CIVH for valuation purposes is Telkom, which owns the fibre operator Openserve. Telkom’s market cap is around R17 billion.

The valuation of CIVH puts its EV/EBITDA ratio at 10.1 times after applying discounts. In comparison, Telkom has an EV/EBITDA of 3.13 times.

CIVH’s price-to-sales ratio currently stands at 4 times its revenue. Telkom, in comparison, has a price-to-sales ratio of only 0.39 times revenue.

This indicates a significant mismatch between Telkom and CIVH’s valuations, although they operate in similar markets.

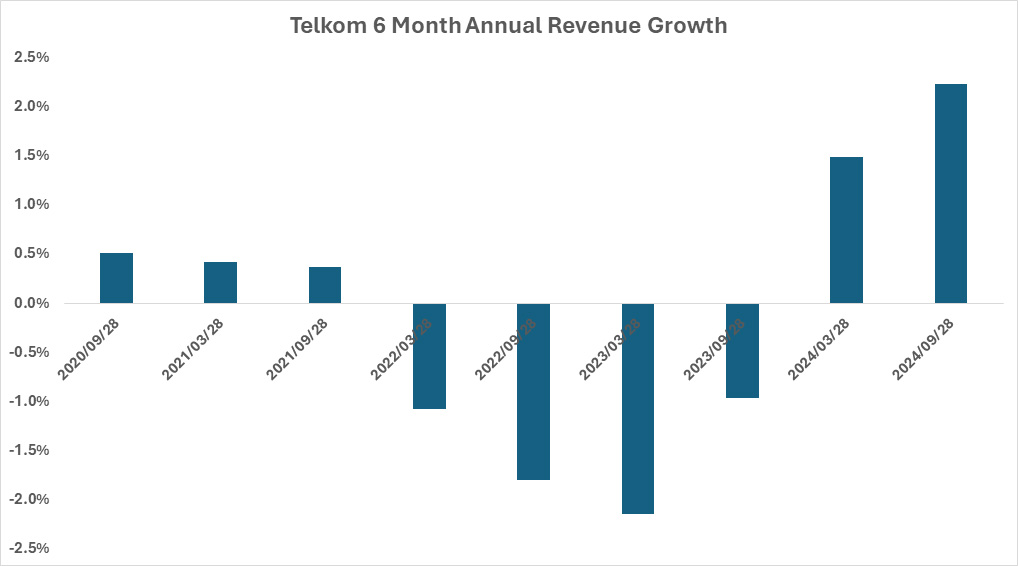

However, there is a difference that should be considered. Over the past 5 years, Telkom only achieved an average revenue growth of 0.7%.

CIVH, in comparison, experienced an average annual revenue growth of 14.2% over the past 5 years.

This is significantly higher than Telkom’s, which could explain the significant mismatch in their price-to-sales valuations.

It should be noted that over the past 5 years, CIVH’s revenue growth deteriorated, with its latest two reporting periods showing 2.25% and 6.5% annual revenue growth, respectively.

CIVH’s declining ARPU

The declining revenue growth can largely be explained by CIVH’s changing customer base and lower average revenue per user (ARPU)

Since the start of 2022, CIVH’s average revenue per user has declined from over R10,000 to slightly over R8,000.

The lower revenue per user is caused by numerous factors, including more affordable fibre products in low-income areas.

Vumatel has rolled out fibre in low-income areas, where its packages are much cheaper than in high-income areas. This change in its user base has changed the customer profiles.

Although there is increased competition in South Africa’s fibre market, it is unlikely to have impacted revenue much.

Fibre network operators typically have a monopoly where they operate, which means competitive forces are not at play in these areas.

CIVH earnings decline

CIVH’s slowing revenue growth is concerning, especially considering it in conjunction with its declining profitability.

Since the end of 2022, Community Investment Ventures Holdings has experienced a deterioration in its bottom line.

After reporting R323 million in headline earnings in its September 2022 interim results, it has seen its profits plummet with each new set of results.

During its latest interim result, CIVH reported a R248 million headline loss, translating to a staggering R418 million headline loss over the past twelve months.

CIVH’s growing debt burden

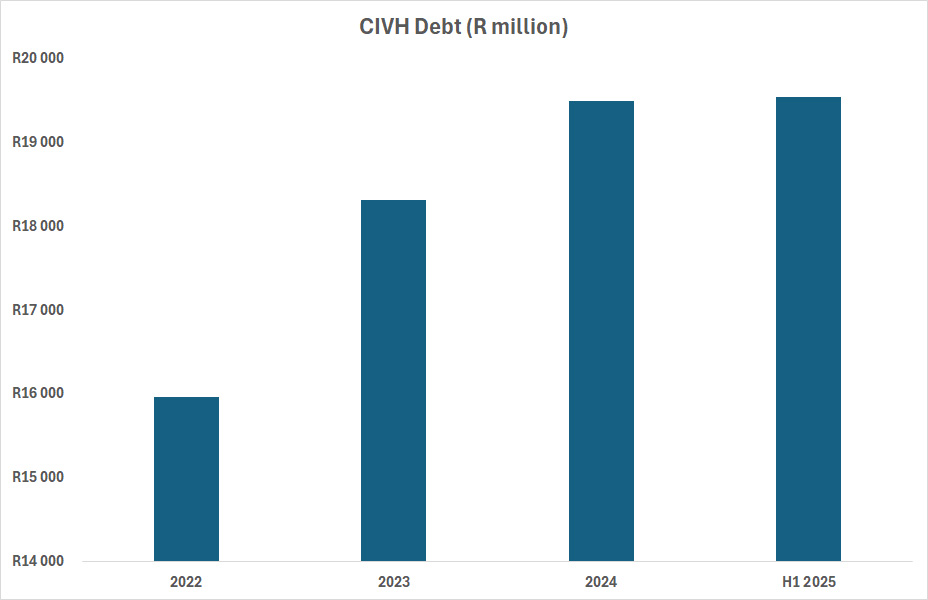

A major contributor to CIVH’s profitability struggles has been its mounting debt burden. During its last results presentation, CIVH reported interest-bearing debt at R19.5 billion.

This translates into a debt-to-EBITDA ratio of 4.42 times at the upper end of CIVH’s debt range limit of 3.5 to 4.5 times EBITDA.

With the increasing possibility of the Vodacom deal not continuing, debt will become a significant issue, increasing the risk of further losses.

During its investor call, Remgro’s management stated that they are exploring other opportunities to pay off debt should the Vodacom deal not continue.

However, when asked about specific alternative avenues to repay their debt, Remgro did not provide any answers.

The Remgro team also preferred not to answer specific questions about the servicing, maturity, and alternative plans to settle CIVH debt.

This caused concern among some analysts about CIVH and Remgro’s ability to meaningfully reduce its debt burden and bring the company back to profitability.

CIVH valuation keeps going up

Despite CIVH’s deteriorating performance and mounting debt pressures, Remgro continues to report increases in CIVH’s valuation.

From June 2022 to December 2024, Remgro increased CIVH’s valuation by R2 billion, equating to 8.2%.

8.2% may not seem like much, but considering the company has not reported more than 10% revenue growth over the past 18 months and its profitability has fallen away, it raises questions.

It is important to note that significant goodwill has already been baked into the CIVH valuation.

Comparing CIVH to other Internet and network service providers shows that CIVH is significantly overvalued.

Over the past 12 months, Telkom reported headline earnings of R40 million, translating to a headline earnings margin of 0.1%.

CIVH reported a headline loss of R418 million over the past 12 months, from a much lower revenue base.

This brings CIVH’s headline loss margin to 6.3%, making it much less profitable than the Telkom Group.

CIVH also has much more relative debt than Telkom, with a debt-to-EBITDA ratio of 4.42 compared to 1.44.

Valuing CIVH at Telkom’s EV/EBITDA margin of 3.1 times would put its valuation around R11.2 billion after applying a similar discount as Remgro to CIVH’s valuation.

Vodacom, in comparison, has revenue growth similar to CIVH’s recent revenue growth. It is much more profitable and has much less relative debt than CIVH.

Using its EV/EBITDA of 5.4 times would put CIVH’s valuation at around R18.6 billion after applying discounts. However, this would be a much less suitable comparison.