From R10,000 to R5.49 million in 10 years

An analysis by MyBroadband shows that a R10,000 investment in Nvidia ten years ago would be worth about 592 times more today.

The share price of the world’s largest semiconductor company closed at a record $155.02 (R2,769) on the Nasdaq on Thursday, 26 June 2025.

The share price has gained more than 14% since Nvidia’s Q1 earnings released in late May 2025. Revenues beat expectations and showed strong resistance against a ban on chip exports to China.

Just before that, the stock also received a boost from major deals to supply AI chips to Saudi Arabia and the United Arab Emirates.

The jumps have pushed Nvidia’s market capitalisation to $3.78 trillion (R67.52 trillion), putting it ahead of its only competitor for the world’s most valuable company — Microsoft.

MyBroadband calculated how much more a R10,000 Nvidia stock investment from a decade ago would be worth today.

After accounting for the two Nvidia stock splits in the past decade, a single share in the company would have effectively been worth $0.52 at the close of markets on Friday, 26 June 2015.

At its record closing price, the share was worth 298 times that by the close of the market ten years later. South Africans investing rands in the US-based company would have seen even larger gains.

On 26 June 2015, the rand was trading at roughly R12.24 to the dollar, and the price of an Nvidia share was $20.80 before two stock splits.

R10,000 would have bought about 39 Nvidia shares. Nvidia’s 4:1 stock split in 2021 and another 10:1 stock split in 2024 mean a shareholder with 39 shares before 2021 would have about 2,145 shares in 2025.

On 26 June 2025, those shares were worth $332,518 — almost R5.94 million based on the dollar-to-rand exchange rate of R17.86 that day.

The table below shows how the value of a R10,000 investment in Nvidia would have changed between 26 June 2015 and 26 June 2025.

| Nvidia share value over 10 years | |

|---|---|

| Single share price on 26 June 2015 (original | adjusted for stock splits) | $20.80 | $0.52 |

| Nvidia shares bought with R10,000 on 26 June 2015 (original) | 39 |

| Single share price on 26 June 2025 | $155.02 (R2,769) |

| Shares owned after stock splits | 2,145 |

| Value of R10,000 investment on 26 June 2025 | $332,518 (R5.94 million) |

| Change including rand-to-dollar changes | +59,288% |

More room for growth — but competition is waiting in the wings

Nvidia is among several listed companies riding a wave of investor optimism over generative artificial intelligence (AI) developments in recent years — and its future potential.

While considered overvalued in conventional stock wisdom, some analysts — including The Motley Fool stock market adviser Justin Pope — believe that the share still has substantial growth potential.

“Unless Nvidia’s business implodes and falls well short of expectations, there’s a good chance that Nvidia produces double-digit annualised returns over the next decade,” Pope said.

However, Loop Capital analysts emphasised that Nvidia was benefitting from essentially being a monopoly in critical tech, with a lot of pricing and margin power. That may not last long.

One area where the company could see strong competition is in the Chinese market, where Huawei is reportedly planning to launch an advanced AI chip to compete with Nvidia’s previous-generation H100.

Nvidia started in the 1990s as a graphics processing unit (GPU) company, with the PC gaming industry as one of its primary markets.

It has grown its portfolio to cater to more diverse markets, including the automotive and AI industries. Its GPUs are also highly sought-after in cryptocurrency mining.

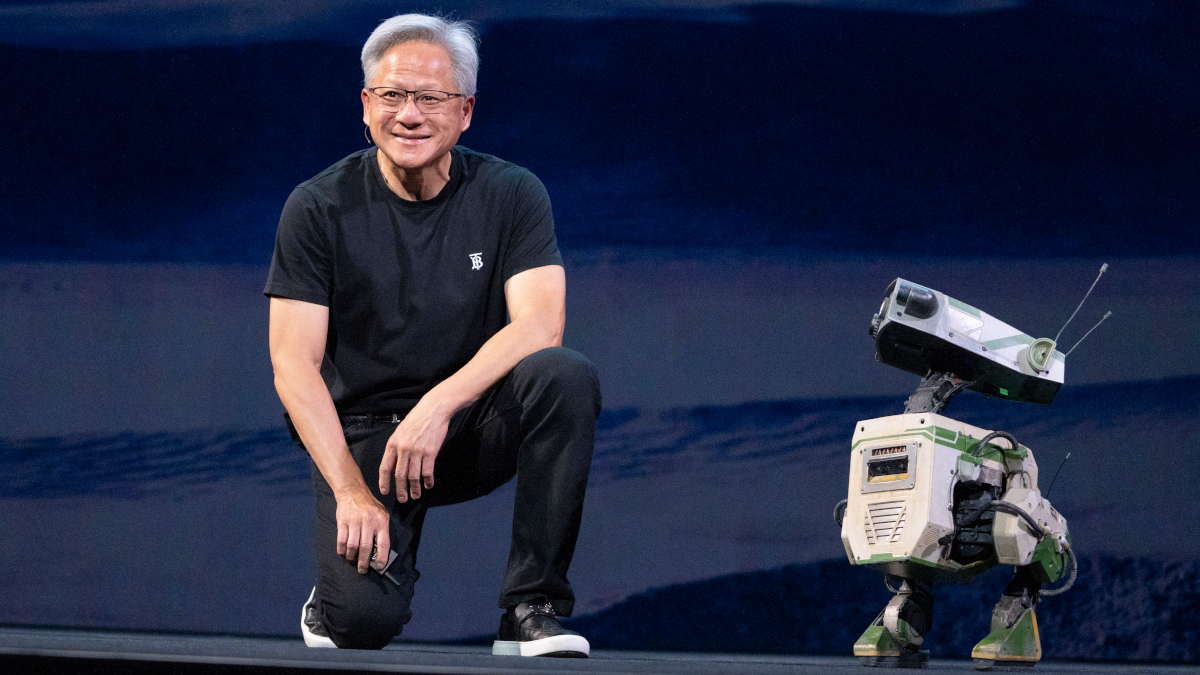

Much of the company’s success has been attributed to co-founder Jen-hsun “Jensen” Huang, who has led the company since its founding 32 years ago.